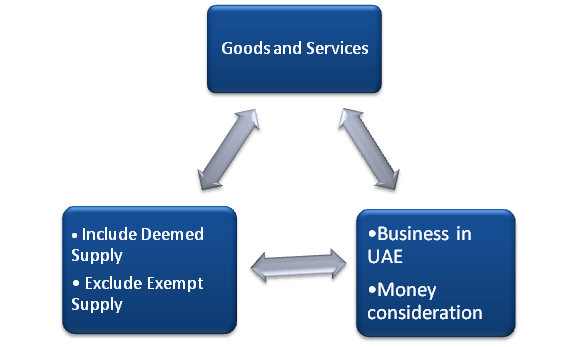

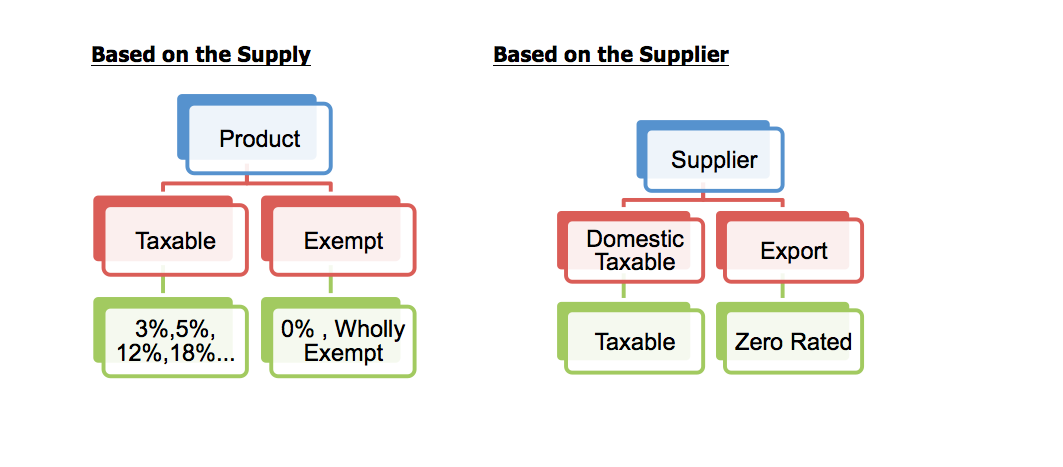

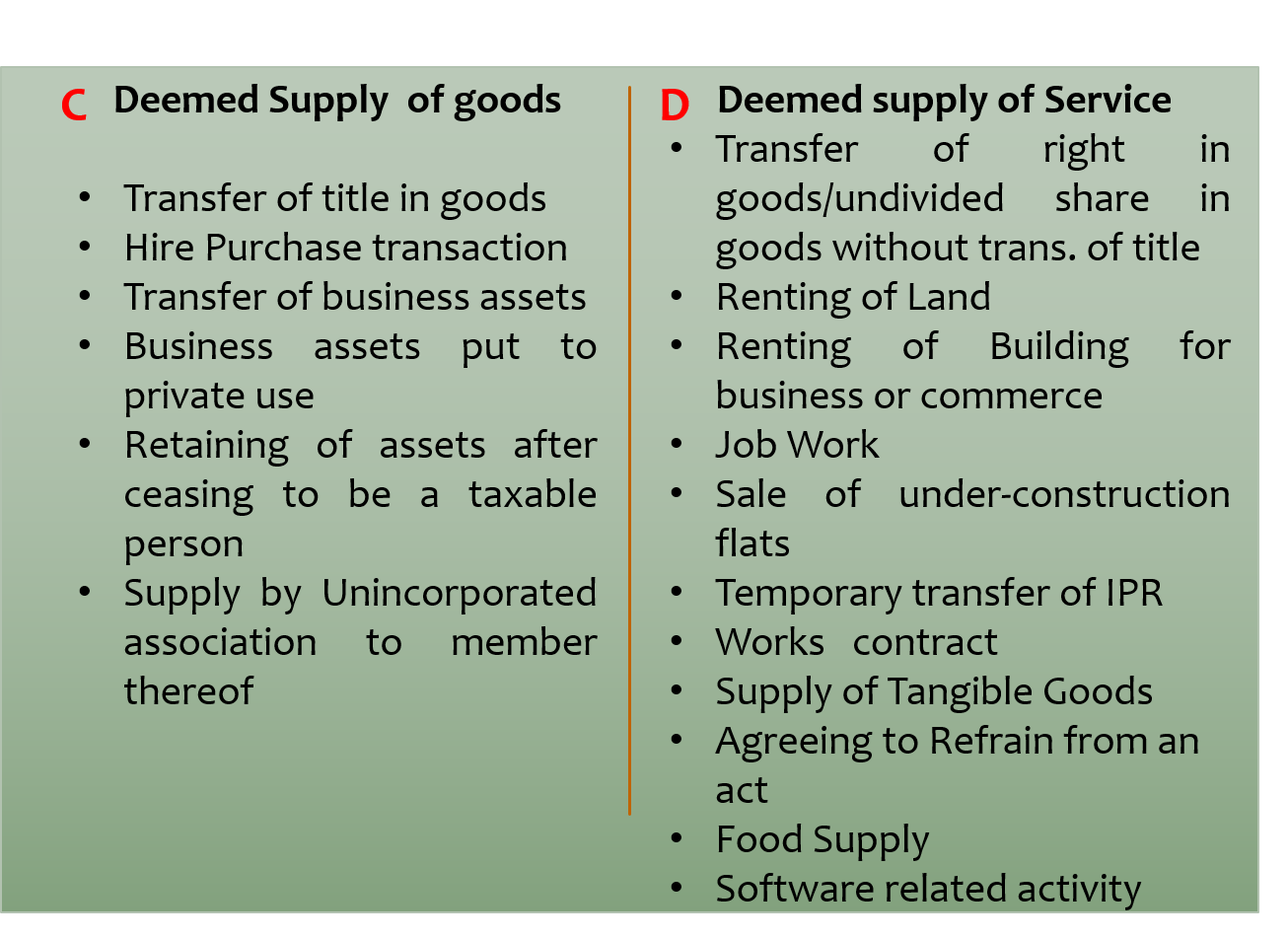

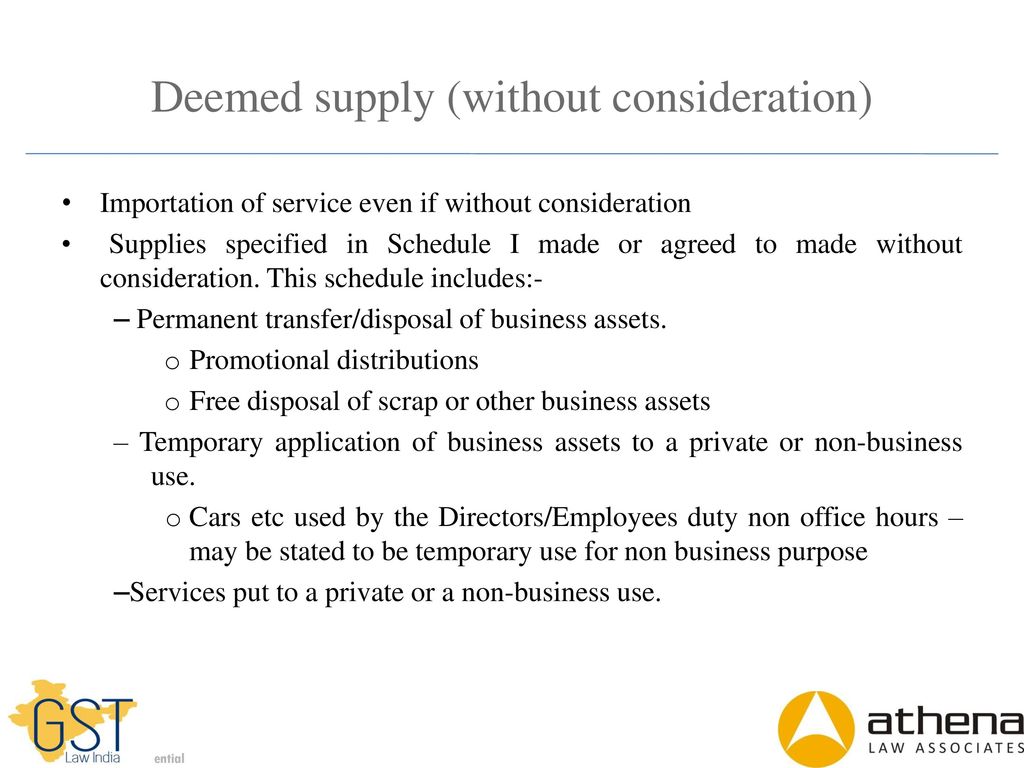

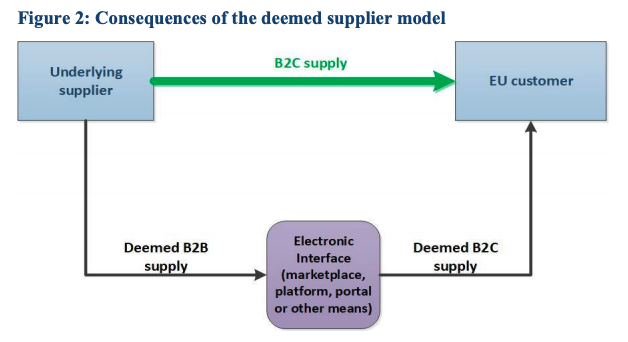

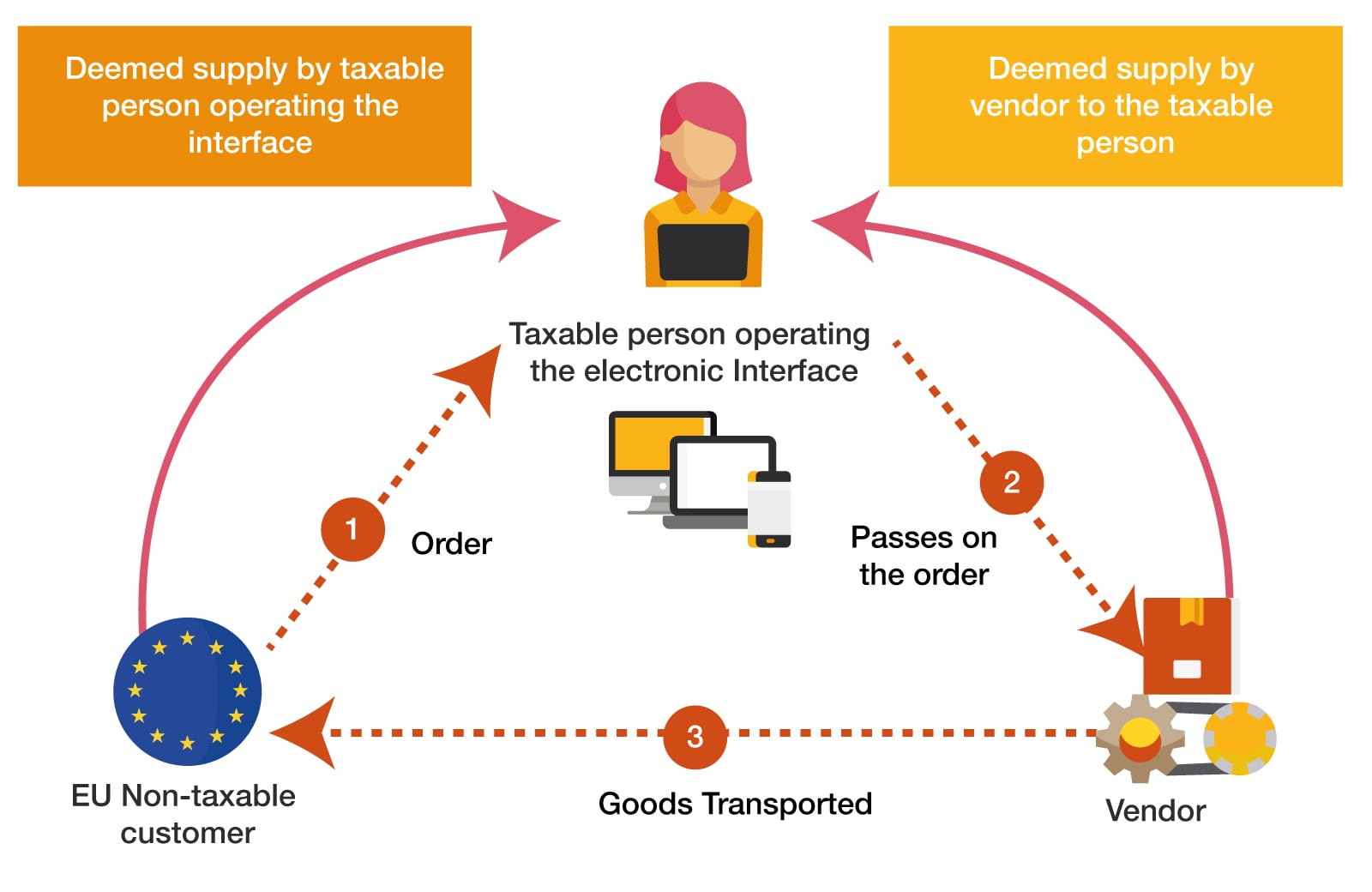

Nexdigm - With #Oman #VAT implementation on the horizon, the businesses must evaluate the compliance requirements. #DidYouKnow which supplies would be considered as deemed supply of goods under Oman VAT? Read through

Research Report: New Rules for Supply Chain Insights, Collaboration and Overall Resiliency | 2020-10-01 | CSCMP's Supply Chain Quarterly